YOUR CAREER IN risk management

IT consulting for banks and insurance companies – that is our passion! In doing so, we ensure a high level of customer satisfaction with our solutions for risk calculations, the integration of adapter solutions with SAP technologies or with performance management in SAP PaPM. Become part of our unique spirit!

Why risk management?

Trust and reputation preservation, loss minimization or sensible capital and liquidity management – There are many reasons why risk management is essential for our clients (

Overview of our client services

). In the same way, there are many reasons for us to start each day with joy:

Wide range of applications

Sustainable solutions

Enterprise-wide integration

Unique we-feeling

“My added value in risk management at ADWEKO? The warm team, working with cutting-edge technologies and the exciting project environment around risk-specific requirements!”

“Here I have found not “only” work colleagues, but also friends!”

OUR FOCUS TOPICS

Risk management

In risk management, you deal with the main types of risk such as market, liquidity and credit risk, among others.

In doing so, you establish risk correlations, are up to date with regulatory requirements (especially BCBS and CRR/CRD), analyze and implement risk functionalities in risk management systems.

Data models

To identify risks, we use various risk measurement systems that must be constantly supplied with correctly prepared data records. This data requires specialized knowledge to implement successful risk measurement.

Within the focus topic “Data Models” you develop the necessary knowledge, move within data and data models and learn to translate customer requirements into data.

Overall bank management

In overall bank management, you combine knowledge of data models and risk management. to offer meaningful conclusions and solutions for the overall bank management of our customers.

In addition, you recognize the needs of the customers, the KPI’s determined in the risk measurement, such as reporting or accounting.

Controlling & Planning

In addition to the classic topics of risk management, you will work with us in the focus area “Controlling & Planning” on typical planning and financial controlling topics, which we primarily implement with flexible, low-code/no-code software tools. You take customer requirements, e.g. for cost and revenue planning, transform them into a solution design and automate the processes within the software tools.

Risk models

In the focus topic “Risk Models” you deal with financial mathematical models, interpret them and explain the effects of parameter changes to our customers, for example to identify potential risks as a basis for decision-making and creating risk-dominating measures. You will also implement the models you have created, or parts of them, in the customer’s systems.

Risk management

In risk management, you deal with the main types of risk such as market, liquidity and credit risk, among others.

In doing so, you establish risk correlations, are up to date with regulatory requirements (especially BCBS and CRR/CRD), analyze and implement risk functionalities in risk management systems.

Data models

To identify risks, we use various risk measurement systems that must be constantly supplied with correctly prepared data records. This data requires specialized knowledge to implement successful risk measurement.

Within the focus topic “Data Models” you develop the necessary knowledge, move within data and data models and learn to translate customer requirements into data.

Overall bank management

In overall bank management, you combine knowledge of data models and risk management. to offer meaningful conclusions and solutions for the overall bank management of our customers.

In addition, you recognize the needs of the customers, the KPI’s determined in the risk measurement, such as reporting or accounting.

Controlling & Planning

In addition to the classic topics of risk management, you will work with us in the focus area “Controlling & Planning” on typical planning and financial controlling topics, which we primarily implement with flexible, low-code/no-code software tools. You take customer requirements, e.g. for cost and revenue planning, transform them into a solution design and automate the processes within the software tools.

Risk models

In the focus topic “Risk Models” you deal with financial mathematical models, interpret them and explain the effects of parameter changes to our customers, for example to identify potential risks as a basis for decision-making and creating risk-dominating measures. You will also implement the models you have created, or parts of them, in the customer’s systems.

That makes

US

from

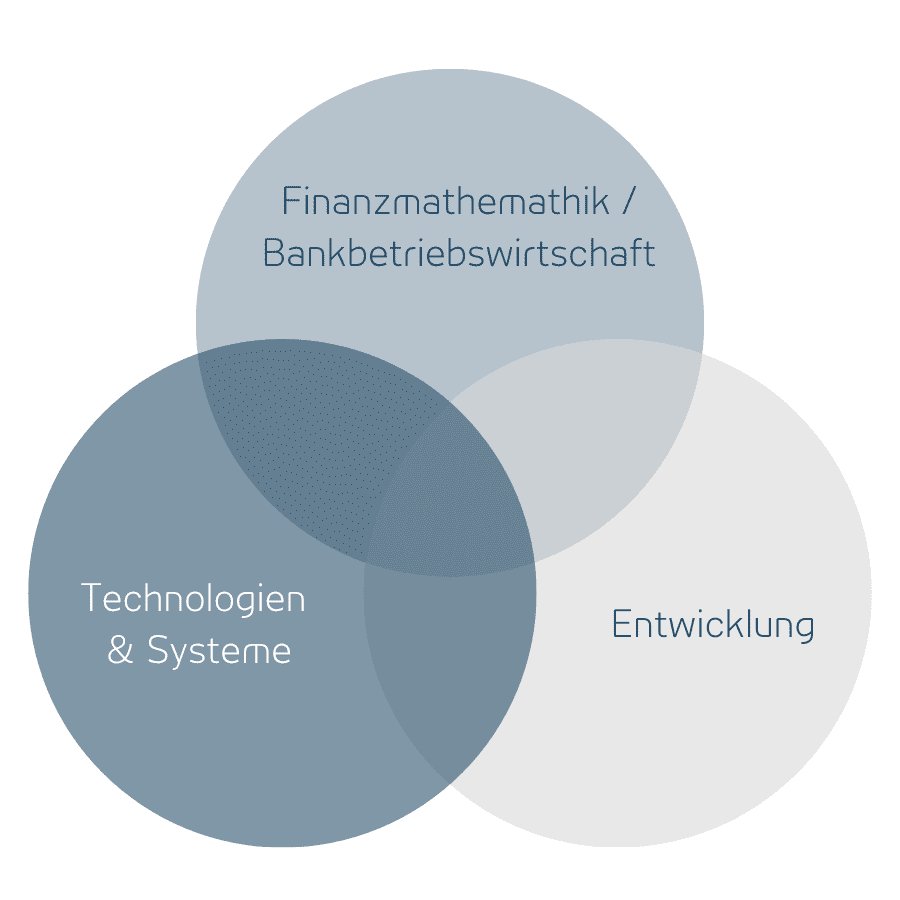

Our professional focus?

With us, you work with and for customers in the financial mathematical and financial engineering fields. business banking and insurance environment. Accordingly, motivation and interest in these topics is essential. You will learn specific skills with us little by little depending on the focus topic and strength.

Work with the latest technologies

We use various software systems and technologies for our daily business. Among other things, the following tools are waiting for you:

- SAP Profitability and Performance Management (PaPM)

- SAP Treasury and Risk Management (TRM)

- SAP Financial Services Data Management (FSDM)

- Wolters Kluwers OneSumX (OSX)

- F.I.S. Balance Sheet Manager (BSM)

- Actico

Develop yourself further

Standstill, no thanks! Whether on a personal or professional level, everyone is constantly evolving through experience. And that’s a good thing: We support you in your personal development, enable you to find the career paths that match your strengths and also keep a constant eye on market developments in order to stay up-to-date and to recognize and take advantage of market opportunities.

INSIGHT BEHIND THE SCENES

CROSS-SECTIONAL TOPICS TO THE OTHER AREAS

Software Solutions Risk Adapter

Risk Management offers implementation services for products developed by ADWEKO, such as ADWEKO Integrate for OneSumX for Risk Management.

This is a standardized data integration layer between the SAP Fioneer Financial Service Datamanagement (SAP FSDM) data model and Wolters Kluwer’s risk management software (OneSumX Risk).

For the further development and maintenance of this solution, we are in a close and continuous exchange with our colleagues in product development.

Regulatory Analytics meets Risk

In Risk Management, the focus is on risk control and risk models, among other things. In accordance with the Capital Requirements Regulations (CRR), the risk ratios determined (e.g. credit risk) must also be included in the measurement of own funds.

In order to be able to offer our customers the best possible complete solution, we are in regular contact with our colleagues in the reporting area (Regulation & Analytics) to discuss current and new regulatory requirements.

Finance SAP

FPSL

Based on the target values delivered from the upstream risk systems (such as interest accrual, risk provision or fair value), SAP Financial Product Subledger (SAP FPSL) posts the change compared to the last delivered values. We in Risk Management, in turn, then access the newly posted values for further risk indicators, thus ensuring that reporting is based on the most up-to-date figures.

To this end, we are in constant exchange with our colleagues in order to harmonize the overarching processes and to recognize and incorporate innovations on both sides at an early stage.

Data X Risk

In cooperation with our Data Management department, we ensure that our customers’ data is stored in a structured manner and is available at the right time and in the right quality for processing in risk management.

For this purpose, we use, for example, the integrated data budget of the SAP Financial Service Data Management (SAP FSDM) solution and its standardized data model for banks and insurance companies in combination with our data quality management solutions such as ADWEKO CONTROL FOR FSDM.