SAP BANKING FOR COMPLEX LOANS

SAP S/4HANA Banking for Complex Loans as Financing Workplace supports you in the effective management of structured financing as well as syndications and offers various functions for handling the complete life cycle of loan agreements.

The SAP S/4 HANA Banking service portfolio for Complex Loans offers a wide range of functions for Origination, Execution such as management and processing of syndicated financing structures, including the syndications, master syndications, master data, terms and conditions, rules, and the necessary business the necessary business transactions.

Transparent & consistent mapping of financial structures

Multi-tier monitoring via convenants, agreements, payment flows, etc.

A single backend for retail & wholesale loans

Transparent & consistent mapping of financial structures

Multi-tier monitoring via convenants, agreements, payment flows, etc.

A single backend for retail & wholesale loans

OUR OFFERING

From the analysis to the development of the target architecture of SAP S/4 HANA Complex Loans as an add-on to SAP Loans Management, ADWEKO accompanies you in your financial your financial IT transformation process.

For the integration of SAP S/4 HANA Banking for Complex Loans for the mapping of complex financing structures and syndications, ADWEKO follows a vertical follows a vertical consulting approach via the bank delivery chain for the delivery route-compliant mapping of loans and also collateral in the overall overall bank management.

Our experts for the SAP Core Banking modules (especially CML) as well as for S/4 HANA will be happy to accompany you from the assessment in the context of preliminary studies to the connection of the credit applications – tailored to your interfaces and target interfaces and target architecture.

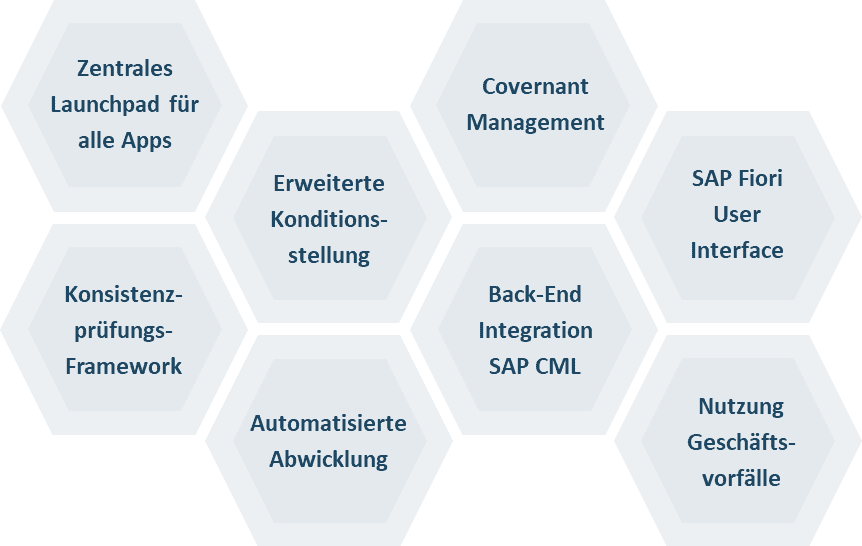

SAP S/4 HANA Banking for Complex Loans – Selected Features and Functionalities

Technical and system expertise in FS specific SAP solutions:

By focusing on SAP’s FS-specific solutions such as PaPM, FPSL, Complex Loans or FAM, we are not only a valued implementation partner but also support banks, insurance companies and other financial service providers in defining viable target architectures together with SAP.

Due to our extensive experience within ADWEKO’s credit management

team, we offer integrated solutions tailored to your needs.