Risk Management

At ADWEKO, we understand your business requirements around risk and can implement them in your systems. We act as a partner who, in the first step, translates your business requirements into the language of IT and then also supports you in the IT implementation.

The trend towards modernization and standardization of system architectures is continuing in the financial industry. The best example of this is the Standard BCBS 239 of the Basel Committee. The new architectures are characterized by a high level of integration of data and functions. We specialize in the implementation of risk management requirements and are also very familiar with the requirements for overall bank management and controlling due to the many technical dependencies.

Risk management based on existing software solutions (Wolters Kluwer OneSumX, F.I.S BSM, SAP TRM)

Integration of the SAP Fioneer FSDM data model into risk management

Calculate and analyze large amounts of data in real time with SAP PaPM

Transparent, semi-automated banking processes based on the actico platform

WHAT WE DO

Find out more about the collaboration between ADWEKO Risk Management and the solutions from Wolters Kluwer, SAP, F.I.S, SAP Fioneer and actico. Our many years of experience and best practices from various integration projects in the financial industry guarantee efficient implementation of your customized requirements.

RISK MANAGEMENT BASED ON EXISTING SOFTWARE SOLUTIONS SUCH AS ONESUMX FOR RISK OR BSM

Wolters Kluwer OneSumX Risk, BSM by F.I.S. and SAP TRM are external risk management systems. We help you to create suitable IT concepts for these risk management systems and then implement them. Typical technical requirements for risk management, overall bank management and controlling that we take into account in this context are the measurement and monitoring of material risks such as credit, market price and liquidity risk, the determination and planning of ICAAP and ILAAP, or pre- and post-calculation.

CONTROLLING WITH SAP PAPM

Calculations and analyses for large amounts of data are possible in real time with SAP PaPM. From various SAP PaPM implementation projects at banks and insurance companies, we know that complexity and flexibility are not mutually exclusive. Instead, we work with your specialist departments to create IT concepts that we can implement individually in SAP PaPM. Based on the documentation created for the implemented SAP PaPM solution, we will enable you to further develop your SAP PaPM solution flexibly and independently.

INTEGRATION OF THE SAP FIONEER FSDM DATA MODEL INTO RISK MANAGEMENT

With our own software solutions

ADWEKO Integrate for FSDM & OneSumX

and ADWEKO Integrate for FSDM & BSM we are specialists for the standardized data model

SAP Fioneer FSDM

. We also have project experience with the integration of the FSDM data model into the external risk management systems Wolters Kluwer OneSumX Risk and F.I.S. BSM.

TRANSPARENT, PART-automated banking processes based on the actico platform

Both new process flows, such as filling out an ESG risk scorecard and determining an ESG score, and existing established process flows, such as credit decisions and internal rating creation, can be mapped transparently and partially automated on the basis of the actico platform. We implement the processes you have identified for you on the actico platform.

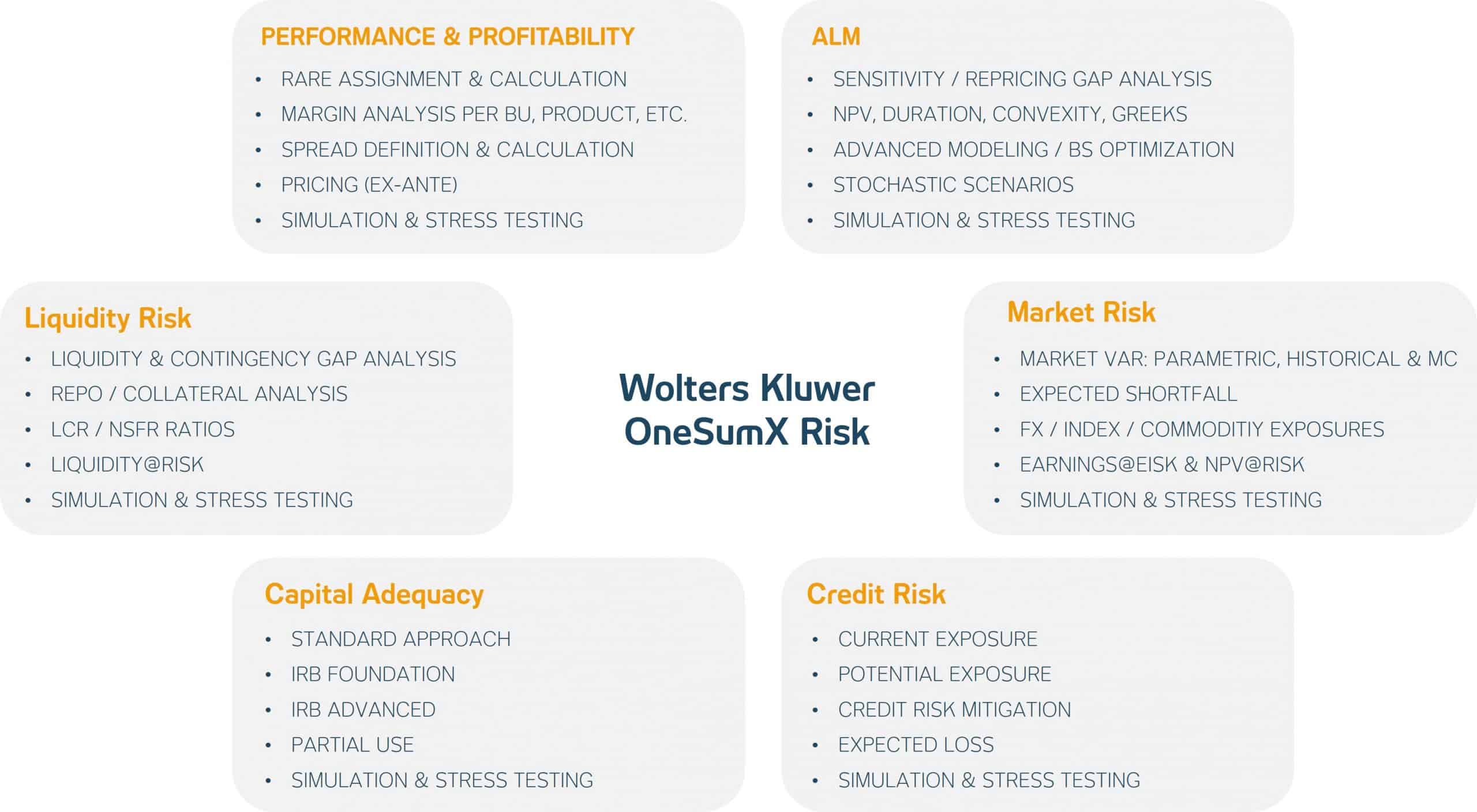

Wolters Kluwer OneSumX Risk

Wolters Kluwer OneSumX Risk is a complex analysis tool for risk and profitability management and comprises various risk management technologies for compliance, credit, market and liquidity risks. We support you with consulting services for the implementation of the Wolters Kluwer solution regarding:

Data integration with ADWEKO Integrate for OneSumX based on SAP Fioneer FSDM Data integration from other data sources via ADWEKO Integrate (“Any DB approach”) Parameterization, configuration & maintenance of the OneSumX Engine

Integrated Solutions

SAP TRM Treasury & Risk Management (SAP TRM)

With “Treasury and Risk Management” (TRM), SAP offers an application for processing your money and foreign exchange transactions, as well as derivatives and securities. Here, the integration with the accounting, cash management and regulatory processes is foreseen and part of the infrastructure of the application. This is composed of the following components:

Transaction Manager

It is used to record and process the specified types of transactions. This offers a wide range of options for presenting the standard market and individual conditions and generating cash flows from them. This is also where the integration into the accounting processes takes place.

Market Risk Analyzer

The key figures relevant in market price risk can be configured and reported according to your specifications. This is primarily for present value viewing and management of your portfolio and includes various stress testing options.

Credit Risk Analyzer

This allows the requirements of a default risk to be mapped and the business base mapped in the Transaction Manager to be evaluated analytically. This includes configuration as well as reporting to actively manage the portfolio in addition to display.

Portfolio Analyzer

This module supplements the aforementioned analyzers with further options for the economic analysis of your portfolio, including benchmarks.

Our expertise in SAP TRM is based on numerous long-term projects for the introduction, further development and maintenance of the application. In addition to configuration and software development, we take on all other roles that are necessary for the implementation of your technical specifications.

Feel free to contact us if you would like to learn more about risk management at ADWEKO. We help you to optimize and automate the risk management processes in your company.