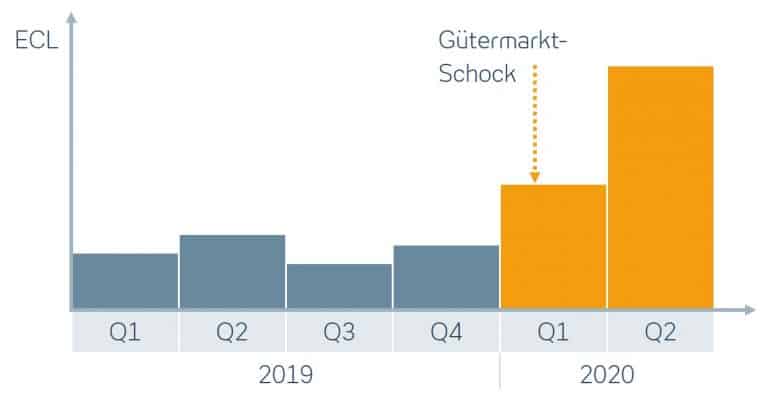

There has not been such a decline in the real economy since the oil price shock in 1973 and the financial crisis starting in 2008. Probably, the situation is without precedent even since the end of the Second World War. We are observing a combined demand and supply shock in the goods markets, combined with a noticeable decline in national income. This is not without effect on the credit markets, specifically on expected credit losses. This topic will be examined in more detail below:

Increase in expected credit loss on a quarterly basis

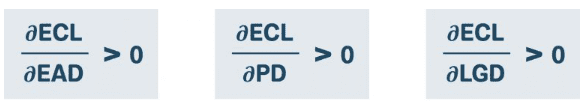

This increase is inevitable, as can be inferred from the definition of expected credit losses. Expected credit loss (ECL) can be defined as follows:

ECL: Expected credit loss

EAD: Carrying amount of the loan receivable

PD: Probability of failure

LGD: Loss rate after liquidation of collateral

All parameters used to determine expected credit losses are >0 and develop in the same direction:

These effects necessarily follow the modeling. Below are a few considerations that support the formal results:

EADs: The formula shows that expected credit losses increase with EAD. This is not surprising. Related to the question of the impact of the goods market shock, EADs are expected to decline less, as indicated by the increasing number of loan modifications, such as repayment suspensions, deferrals, or rollovers, as well as the decline in unscheduled repayments. Together with the increase in the other parameters, this effect therefore also has a correspondingly increasing impact.

PDs: PDs definitely increase due to the goods market shock and the resulting effects on national income. A decline in the goods market leads to falling income and negative growth. Many models used to determine PDs have GDP growth as a variable.

LGDs: The LGD ratio describes the portion of the outstanding receivable amount that is not covered by collateral. A goods market shock and its impact on incomes causes asset and real estate prices to fall. Collateral prices can fall so much that the safety buffers in valuations are depleted and LGD ratios rise.

Increased pressure for further efficiency improvements

Operationally, the decline in the real economy is making itself felt in many places. In any case, a significantly increased workload is to be expected in loan administration, and possibly also in the liquidation of collateral. The impact on the earnings side should also not be underestimated, either directly through impairment losses, or indirectly through the increase in risk provisioning. This is an important point to start at. This is because the low interest rate policy that has prevailed since the financial crisis has caused financial institutions’ margins to shrink significantly. This increases the pressure for further efficiency improvements, for example by optimizing workflows in the operational systems. Due to the size of the shock, however, it cannot be ruled out that feedback to controlling systems will be required.

A key question is therefore at what point operational specifications, processing, etc. become subject to a “control proviso” and how this can be implemented. The second question is how this can be optimized in the workflows and operational systems. We are currently working flat out on precisely this issue, in close cooperation with our customers. In doing so, we apply the design thinking method in order to be able to quickly provide a custom-fit solution. We will keep you up to date on current developments in this BLOG.

Steffen Egly has been working in IT consulting for over 20 years, predominantly with a technical focus on insurance and banking topics. His fields of activity are insurance portfolio management, accounting, provisioning, loans and impairment.

0 Comments