ESG – Corporate Sustainability Reporting Directive (CSRD) concretized by EU/2022/2464

The CSRD is a proposed revision of the existing Non-Financial Reporting Directive being developed as part of the EU legislative process. The determining factor is the NFRD (2014/95/EU) of the European Parliament and of the Council of 22 October 2014 amending the Accounting Directive (2013/34/EU) with regard to the disclosure of non-financial and diversity information by certain large companies and groups. In addition to further measures to optimize sustainability reporting for companies already required to report, the CSRD results in particular in a comprehensive expansion of those required to report, as detailed in our article.

Arne Wandt, Senior Conusltant in Regulation & Analytics

CSRD in conjunction with the Directive on Corporate Sustainability Reporting EU/2022/2464

The CSRD greatly expands the reporting requirements for ESG information within the disclosure. Whereas previously only large companies were affected in accordance with the NFRD, in the future, starting with the 2025 reporting year, large companies that are not subject to the NFRD and meet two of the following three criteria will also be affected

- Balance sheet total greater than 250 million euros

- Net sales greater than 40 million euros

- Number of employees at least 250 employees

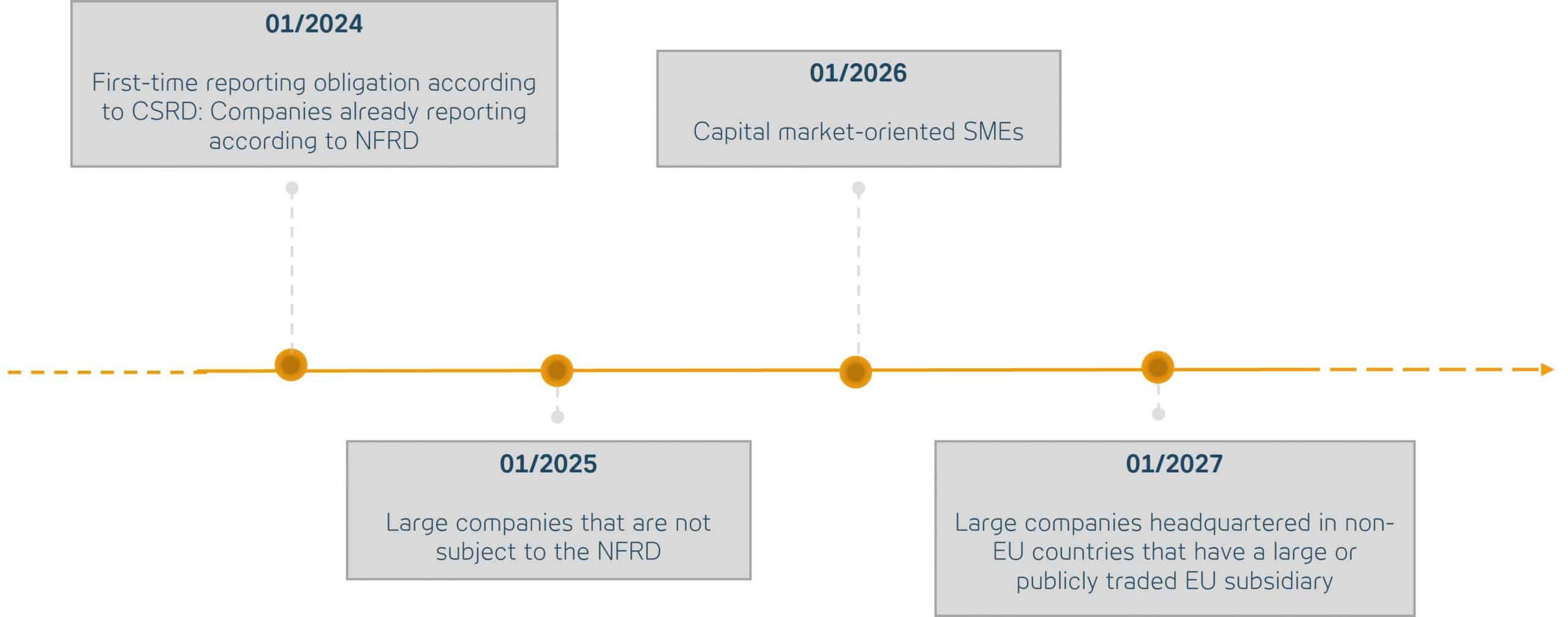

In addition, small and medium-sized enterprises (SMEs) will also be affected from the 2026 reporting year, provided they are capital market-oriented. Finally, as of the 2028 reporting year, companies outside the EU are also required to report if they generate net sales of at least EUR 150 million and have at least one major subsidiary, and/or a branch in the EU. The following timeline illustrates the introduction of the CSRD reporting requirement.

Scope of regulation

Small and medium-sized companies in particular, which have so far recorded virtually no ESG information, will be hit hard by the CSRD. From then on, they are also obliged to consider and quantify the issue of ESG in their company. However, there are also innovations for companies that already disclose ESG information.

One of the most important relates to the expanded and unified reporting requirements, which call for comprehensive and standardized reporting through greater quantification. A standard is currently being developed by EFRAG for this purpose.

Another important innovation is dual materiality, which requires companies to report not only on the impact of sustainability aspects on the company, but also on their impact on people and the environment.

The audit depth is gradually expanded, starting with limited assurance and then with reasonable assurance, which corresponds to the financial reporting framework. This was determined by the EU Commission.

The management report also undergoes a change, as sustainability information becomes a mandatory part to facilitate the accessibility of this information.

In addition, a uniform, electronic reporting formatis specified . In the future, disclosure must be made in the European Single Electronic Format (ESEF). This corresponds to a machine and human readable xHTML format.

In conclusion, it can be said that the new EU sustainability guidelines are a further, important step towards comprehensive and standardized sustainability reporting, requiring companies, including banks, to report comprehensively on their sustainability performance and to take into account their impact on people and the environment.

Since the CSRD has, above all, enormously expanded the group of companies required to report and also affects companies that may not yet have dealt with the topic, our recommendation is to deal with the topic and the internal implementation status as soon as possible and to check which measures may need to be taken.

We at ADWEKO and Regulartech-IT-Audit-Consult are happy to support you in ESG preparation and implementation as well as in determining your implementation needs and efforts.