The SAP Bank Analyzer CRA (Credit Risk Analyzer) is used to analyze, measure and manage credit default risks. The resulting results data are transferred to the Abacus360 reporting software, among other things, for reporting purposes as part of solvency reporting. The focus is on the following functions:

- The determination of the credit risk calculation according to the Credit Risk Standardized Approach (CRSA)

- The internal ratings-based approach (IRBA)

- Credit risk mitigation through collateral recognition (CRM).

In addition to the result data determined in this way, which is transferred from the Result Date Layer (RDL) to Abacus360, other basic data (such as business structures, key figures, values or attributes) is also required for the creation of the solvency report. Since this basic data is already required for other reports (e.g. Large Exposures (LE), LCR/NSFR, BiSta, ZiSta), a raw data-based delivery from the Source Data Layer (SDL) of SAP Bank Analyzer to ABACUS is usually already made for this purpose.

Thus, depending on the “usage intensity” (approaches, elective rights) of the CRA, all or a large part of the data required for a credit risk calculation of the OwnFunds report within ABACUS is already available in ABACUS.

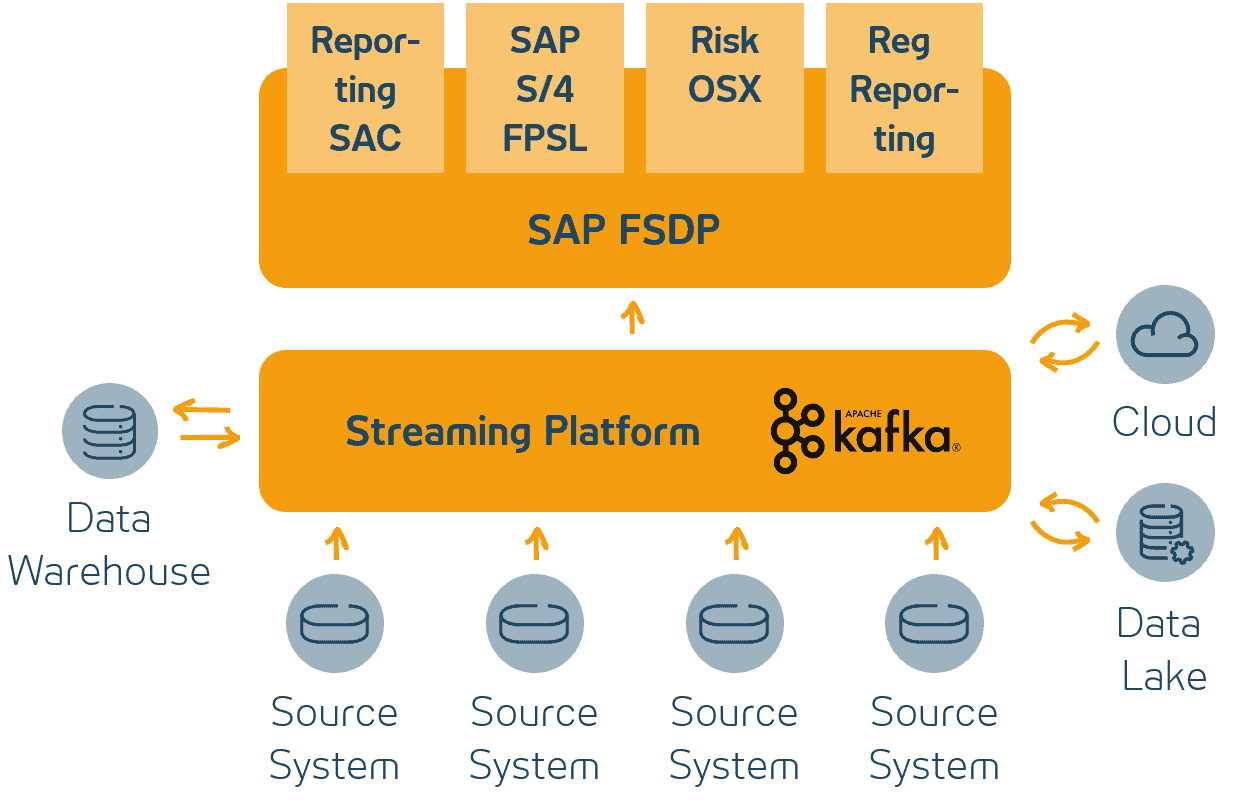

The following diagram illustrates the data flow.

Figure 1: Overview target architecture

Regulatory reporting software Abacus360 replaces SAP Bank Analyzer CRA

As of 2025, SAP will discontinue support for SAP Bank Analyzer and thus also for CRA. An alternative of the addressed functionalities is therefore urgently needed.

An efficient option for institutions is already the transfer of the determination to Abacus360 (or ABACUS/DaVinci embedded). A corresponding calculation is implemented in the associated “Own Funds” module, which can perform the credit risk calculation in the standardized approach (CRSA), the IRBA and the collateral eligibility. The raw data required for this are already available in many cases. The data attributes required for the LE and liquidity reports can be used for exposure class determination. Sovereign, issue and issuer ratings are also already available for LE, liquidity reports and securities reports. The use of the IRBA additionally requires the provision of customer-related rating information and the so-called recognition and exposure class segmentation; a manageable effort with high savings potential. The collateral imputation has already been implemented almost identically for LE reporting, and the required delivery is based on raw data. The same applies to the determination of free credit lines or for small and medium-sized enterprises (SMEs, change due to CRR2), so that almost all required raw data information is already available in Abacus360.

With this solution, ADWEKO was able to demonstrate in an initial customer project that existing Abacus360 users can rely on an already fully functional, established and future-proof solution using IRR raw data delivery that ensures high quality without requiring a great deal of customization in delivery.

0 Comments