From the author’s point of view, it is the continuing and probably even worsening trend of declining earnings, mainly due to ever smaller margins in the lending business. Another major issue is the establishment of negative interest rates. What influences does this have on the entire business model of banks, on their role as financial intermediaries, on balance sheet structures, on products and on customers?

There will be a series of publications on these issues in the coming six months. These are to be considered from the perspective of finance. There are three significant influencing variables for the analysis / consideration of decisions and courses of action:

- Technological progress

- Regulatory

- Political decisions and market reactions

These influencing variables are analyzed in more detail below. Let’s start with technological progress. The technical possibilities for using and processing very large amounts of data have improved significantly. This opens up a wide range of possibilities for reporting and control. In return, however, the requirements for availability and provisioning times also increase. Of central importance in this context is the use of existing data (e.g. documents or cash flows) from a wide variety of systems. On an abstract level, it is about the centralization and standardization of information and the use of existing data.

Regulatory requirements, upcoming and past, tie up capacities and cause expenses. Even without upcoming new requirements, the very fast pace of regulatory topics in previous years, such as IFRS9, has forced many companies to decide to postpone technologically desirable solutions in favor of solutions that can be implemented more quickly in terms of deadlines. Here, the need arises to integrate the special solutions, which often require a great deal of manual effort, into a uniform architecture. The efficiency gains this makes possible are urgently needed to improve the earnings situation.

A major driver of change will be politics, or the reactions of market participants to the political framework. Regardless of one’s political stance on the individual issues, there is no way to avoid strategically considering the consequences of political decisions. There are essentially two points: Monetary policy, whose expansionary orientation has led to massive interest rate cuts and even negative interest rates, and the tendency toward state interventionism in the provision of investment funds that can be observed in many Western countries.

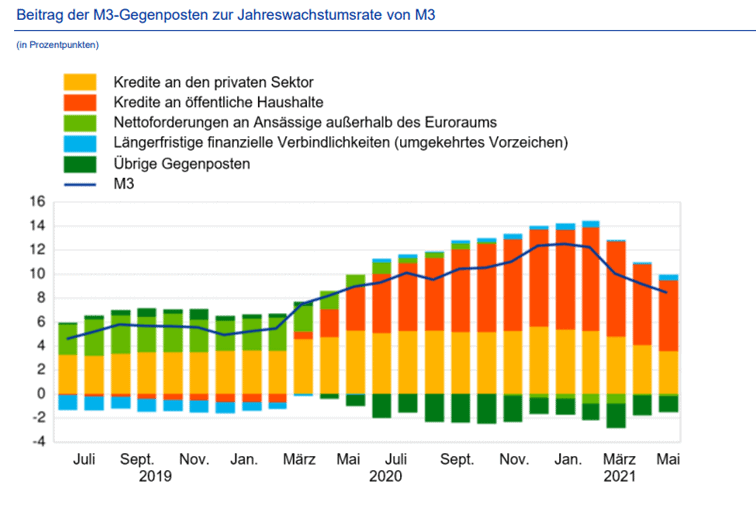

The following ECB graph illustrates the effect of the joint increase in money supply and government debt.

Source: ECB press release of 25.06.2021

This development has a significant impact on banks’ products, margins and balance sheets. The main question here is where future deposits will come from. In a scenario of long-term low interest rates, traditional deposits (demand deposits) will decrease. These could fall to the minimum corresponding to the function of transaction cash if the function of storing the value of money is no longer present. This also has implications for the role of banks as financial intermediaries. Provocatively asked: Are banks being pushed into the role of intermediaries for politically desired investment funds that replace existing deposits? What does that mean for liquidity planning, for the balance sheet? At what rate will these changes occur? Is this now the disruptive change that has been talked about for years, the “black swan”?

Steffen Egly has been working in IT consulting for over 20 years, predominantly with a technical focus on insurance and banking topics. His fields of activity are insurance portfolio management, accounting, provisioning, loans and impairment.

0 Comments