Data Culture: How Financial Service Providers Must Change to Become Data-Driven

Companies are now spending many billions on data-driven solutions or Artificial Intelligence (AI). But to realize the full potential of data, banks and insurance companies need to create a data-driven culture – a Data Culture.

“Only financial services companies that create a successful data culture will optimize their business decisions, accelerate their growth, and remain competitive against FinTechs in the long run.”

Jan Taraldsen, Manager and Head of Business Analytics

Democratization of data at all organizational levels

Data Culture is the way an organization uses data to make decisions and achieve business results. This is not just about collecting and analyzing data, but also about creating a culture that is entirely based on data. This means that data plays a role in all aspects of the organization – from strategy development to capital investment to sales management.

Tip: A successful data culture requires not only a strong data analytics capability, but also a change in organizational culture.

In a data-driven organization, every employee is aware of this and bases their decisions on data. However, many organizations still lead a “gut feeling” culture where decisions are made based on experience and intuition. On this basis, transformation can be challenging.

When banks or insurers set themselves the goal of becoming more data-driven with the help of data and analytics technology, they face certain challenges. These are primarily not a lack of data or the necessary software, but a lack of data-oriented behaviors, beliefs about the use of data, and cross-functional collaboration.

Journey to a data-driven enterprise: top-down approach for implementing a data culture

So how do you introduce a data culture at a financial services company? There is no simple answer to this question, as every organization is unique.

Tip: The SOGDAT principle

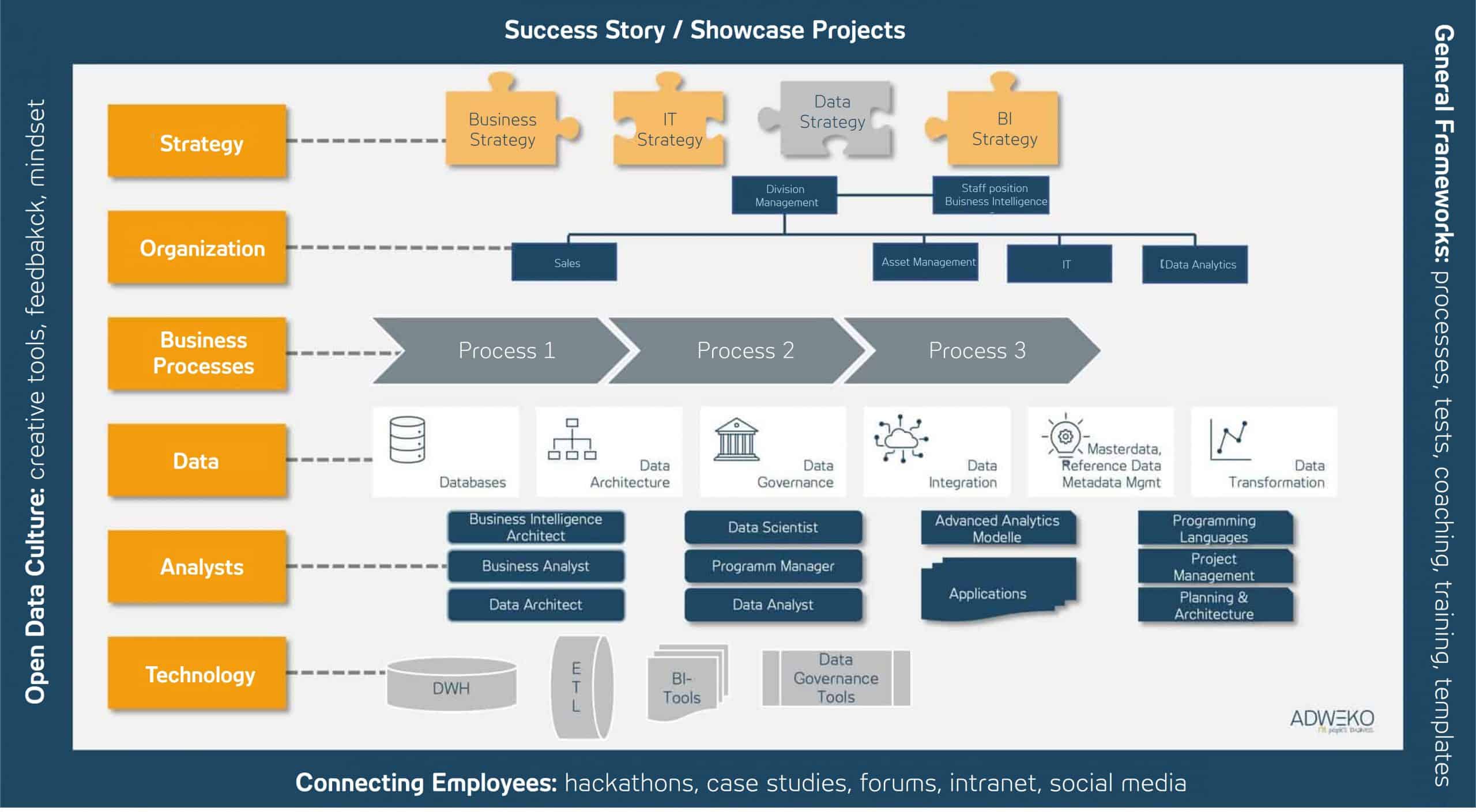

The SOGDAT principle (Strategy, Organization, Business Processes, Data, Analysts and Technology) is a proven process model that takes a holistic view of financial services companies and emphasizes the following:

After an initial inventory of the prevailing use of data throughout the company, which identifies gaps and inhibitors of data use, a strategy is then developed to close these gaps.

“To create a successful data culture, companies and organizations must change their structures and processes and ensure that all employees have the necessary data analysis and interpretation skills.”

This also requires strong leadership that prioritizes data and recognizes the value of data as a critical element of business success.

Strategy, strategy and again strategy

First, it is important to define visions and goals at each management level. Without an explicitly formulated and communicated data strategy that is both embedded in the company’s business strategy and tangential to its IT strategy, a data culture will not be able to make a long-term strategic contribution to the company’s success. It should also be clear before implementation what companies want to achieve with the introduction of a data culture. Financial services firms need to have clear goals for their data analytics and data strategies to ensure that visions and objectives are aligned with business goals. Optimally, an enterprise-wide data strategy is broken down into sub-strategies of different areas, such as lines of business of an insurance company, which breaks through data silos and highlights cross-divisional synergies. As a result, strategies, goals and their operational implementation can support cross-functional data products and the creation of virtual teams.

A culture of data openness starts at top management level

On the way to becoming a data-driven financial services company, it is essential to form a leadership culture at management level that bases its decisions on data. To do this, executives must first understand the importance of data and integrate data analytics into their decision-making. Incentives for leaders who successfully use data to solve problems and identify opportunities can be supportive. Metrics that promote data products should be selected with great care to set the optimal steering incentives.

Tip: For example, a cross-domain quality measure for forecasting loss events, which includes data quality in acquisition as well as processing, can improve the forecasting model in the long term.

In addition to leadership characteristics and incentive compatibility, a gap analysis of the organizational and operational structure must also be performed with regard to data products and their maturity level. Is there already a central data organization? The structure of such a department is oriented to the business-specific requirements. Within this framework, a Data Culture Multiplier can be appointed to take responsibility and leadership for implementing the Data Culture. The multiplier, who is well networked within the company, should have sufficient knowledge and experience in dealing with data and be able to motivate and inspire others.

Invest in the necessary tools and resources

Employees must be trained for the different roles in the company that arise with the introduction of a data culture. Investing in the necessary tools and resources to drive data analytics capabilities throughout the organization is a key component.

“One is investing in leaders so they understand the skills needed for data analytics and are able to base decisions on data, lead and support their teams accordingly.”

And secondly, in the employees themselves, so that they understand the fundamentals of data analysis, tools and technologies required for the operational implementation of data products in a Data Culture in all departments. From a data culture standpoint, there are different tasks and roles in the data-driven enterprise.

While data and product owners are responsible for the data in their specialist area as decision-makers, the data strategy officer is responsible for the detailed design of the data organization and implements the data strategy. The data managers, who keep an eye on the consistency and connection of the different source systems, work somewhat more operationally. Data stewards are responsible for individual data domains and act as a link between the departments and the data organization. In addition to these roles, there are a variety of other manifestations, e.g., Data Engineer, Business Intelligence Developer, Data Scientist, or even Data Governance Officer.

Business processes are the soul of the data factory

Data is created on the basis of business processes. This makes clear sequences for data collection, analysis and use all the more important. These processes should be centrally documented, accessible and understandable for all employees.

Another important element for a functioning data culture relates to the data itself. In the highly regulated financial services sector, companies need to ensure that they have high-quality, clean and reliable data that is relevant for decision-making. By expanding a data quality strategy as part of data governance, they ensure that data quality is high and data security is guaranteed.

Cornerstones of the Data Culture Loop

The dimensions of data culture already described are all necessary conditions of a data culture. Data Culture Loops extend this to include sufficient conditions and describe the important cornerstones that really bring a Data Culture to life. One important element is that employees are connected across the company and across departments.

Tip: Data Culture can e.g. in the context of workshops or via user profiles in the form of data organization, a kind of social data feed on the intranet or social media.

In addition, it is important to spread success stories. The old adage still holds true:

“Do good and report it”

The framework is provided by interactive presentations, newsletters or virtual meetings. These cornerstones are flanked by a framework of proven process methods, use case catalogs, retrospectives, templates, or regular training sessions and internal knowledge transfers. Everything culminates in a detailed plan for the introduction of a Data Culture, which describes the different implementation phases.

A data-driven culture is an important factor in the success of financial services companies undergoing transformation. Companies need to change their organizational culture and ensure that data plays a central role in their decisions and business processes. First and foremost, this requires an integrated data strategy, continued investment in training and education for all stakeholders, fostering an open and transparent data culture through enterprise-wide networks and show case forums, a focus on business goals, and a willingness to experiment, iterate and yes, also fail the one or other time.

Identified gaps according to the SOGDAT model can help to concretize needed resources and timelines for the way to a true Data Culture and to create a roadmap. Only if financial services providers manage to form a Data Culture will they be able to make data-driven decisions, gain competitive advantage, and prevail over one or two other FINTECH.

We at ADWEKO are happy to provide you with our expertise.