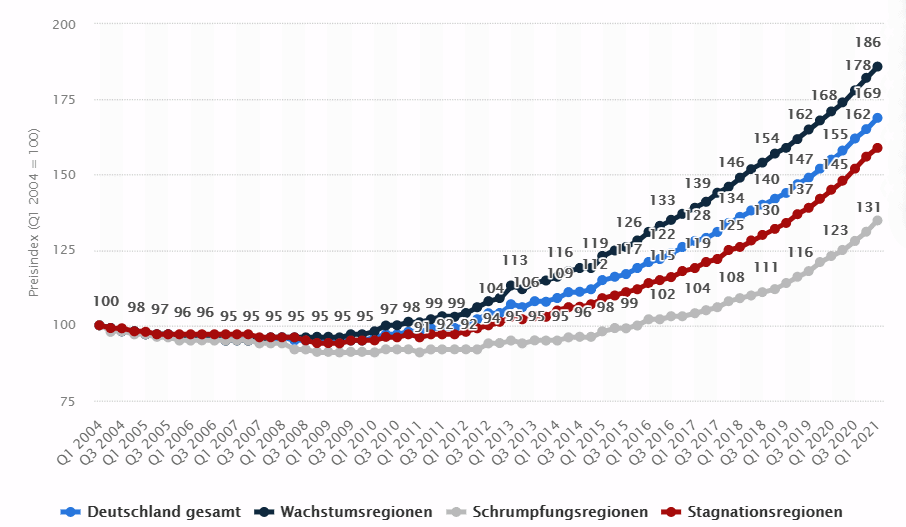

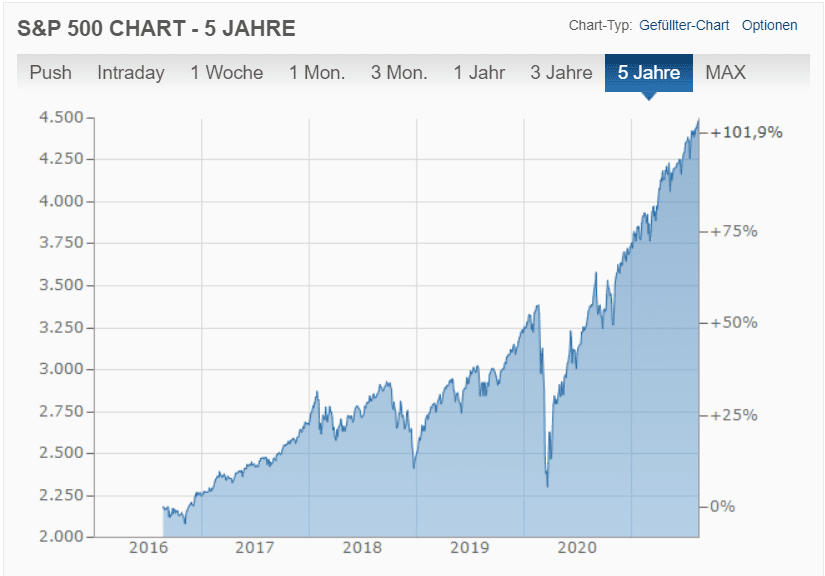

Real interest rates of 0%, or even a little below, have been observed for some time now. Longer here means a decade, or the time since the financial crisis. Investors and private households have anticipated this situation, resulting in rising prices in asset classes such as real estate, equities and also precious metals.

Development of real estate prices in Germany from 2004 to Q1 2021 Source: Statista

Development S&P 500 Index since 2016 Source: finanzen.net

Not every correlation indicates causality. There is certainly more than one variable that can explain this upward price movement. Very few people will probably claim that low interest rates have no influence whatsoever on these price increases.

2021 will be a year with significantly negative real interest rates. In addition to a marked increase in the general rate of price increases, negative nominal interest rates on credit balances are now also being observed, mostly in the form of fees. What impact will this have?

In economic theory, the following functions of money are mentioned:

- Means of exchange and payment

- Value measurement / unit of account

- Store of Value

In an inflation and negative interest rate scenario, money loses its function as a store of value. This is a dramatic cut. One only has to realize in how many areas this storage function is of central importance besides classic savings formation:

- In the actuarial reserves of long-term insurance contracts, above all also in health insurance

- In all forms of funded old-age provision

- In instanthaltungsrücklagen of real estate

The author is not sure whether the dimension of this issue has fully arrived in the broad. There is much more to it than the visible effect of getting 0% interest on your savings and then having to pay a “custody fee” as well. If you want to hang the topic a little higher, you will see the following consequences for your life:

- You have to stay healthy for a very long time and earn an earned income

- You have to get out of money and invest in things that have a store of value function

- It is becoming increasingly difficult to become financially independent of the state and its redistribution systems, especially for risk-averse people

The decline in the value of money also makes the flight to consumption a rational decision. Wouldn’t it even make sense to incur debt to consume at a time like this? You may even have to pay back nominally less than you received. Can this work? Under what circumstances would you get money from someone? In the private sector, you would have to find someone who values the future benefits of money very highly, or is altruistic. For an institutional creditor, it would only be rational to lend money if the loss in value of the money lent is less than the loss in value without lending.

But where will the funds or assets come from in the long run that could be lent if saving in money is no longer rational because of the lack of value? This is what the next article will be about….

Steffen Egly has been working in IT consulting for over 20 years, predominantly with a technical focus on insurance and banking topics. His fields of activity are insurance portfolio management, accounting, provisioning, loans and impairment.

0 Comments