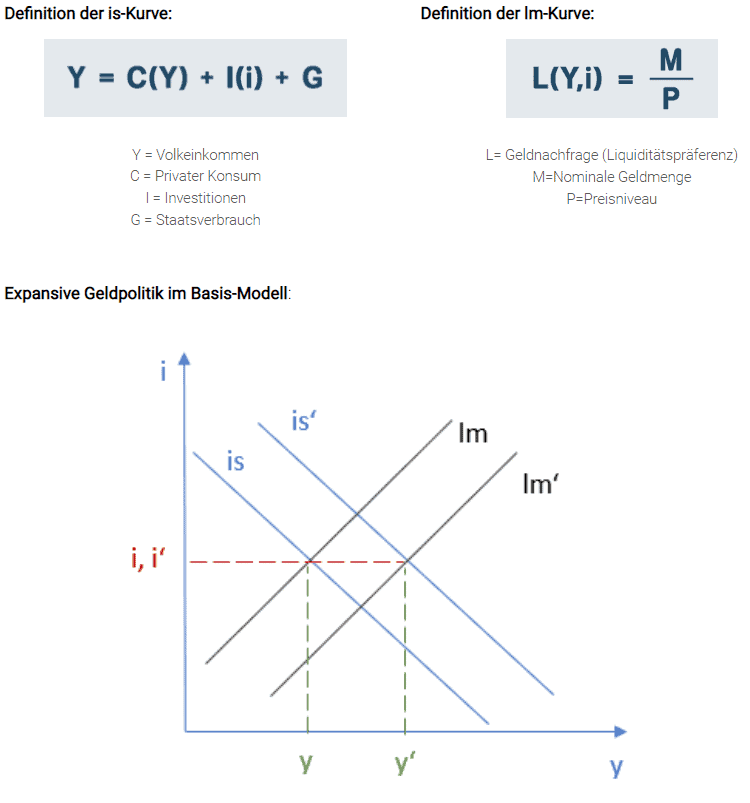

The purpose of this article is to analyze the possibilities and modes of action of the measures taken by the states and the central banks. The “is/lm model” commonly used in macroeconomics is suitable for this purpose. In this model, the goods market equilibrium (is curve) and the money market equilibrium (lm curve) are considered.

In a perfect model world, an expansion of the money supply, symbolized by the rightward shift of the lm curve, can lead to higher national income. Low interest rates lead to a positive impulse on goods markets, the is curve also shifts to the right, interest rates and national income rise. The chart suggests that one can increase national income through appropriate monetary policy without changing the long-term interest rate. Everything depends on how the is and lm curves run.

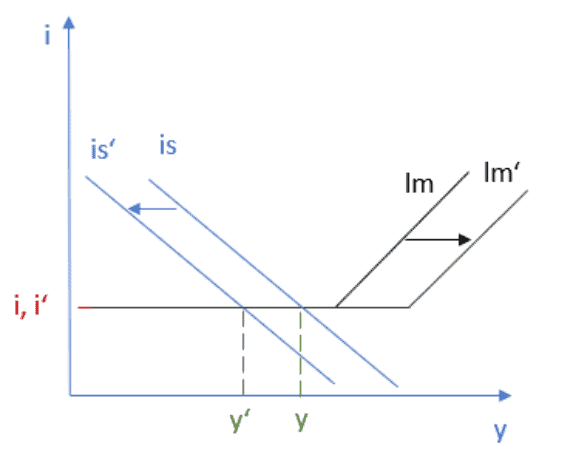

Expansionary Monetary Policy in the Liquidity Trap

What do these curves look like in the current situation? The decline in the real economy causes the is curve to shift to the left. The expansion of the money supply by the central bank in recent years has resulted in a very flat lm curve. A further expansion of the money supply no longer leads to an increase in income.

This situation is called a liquidity trap. In the liquidity trap scenario, only fiscal policy is still effective. Mario Draghi pointed to this situation at the end of his term. European economies were already in the liquidity trap before the Corona crisis, and the situation in the U.S. is similar.

The classic driver of inflation

Why a lot of new money is being created now anyway is an intriguing question. States take on new debt in order to be able to pursue fiscal policy. Central banks buy up government debt instruments and thus create money. In the current situation, the goods market shock means that a reduced volume of goods is offset by an expanded money supply, the classic driver of inflation. Now, fiscal policy measures are doomed to success so that national income will rise again. In addition, the central bank must monitor price developments in order to prevent or mitigate inflation. In principle, it would have the options. It could, for example, withdraw liquidity from the economy again by selling government debt instruments. This is at least theoretically possible, but one should practically answer the following question: Who would buy a government debt instrument with an extremely long maturity and interest rate of zero or less when the economy is back on a growth path?

So much for the model, which hopefully provides some insight into the current situation.

Where is the overall development heading?

Banks will have to deal with the issue of rising credit losses (Part 1). Private demand is not likely to be available as an economic driver (Part 2). The corporate sector has its own challenges, the low interest rates and resulting misallocations have their price (Part 3).

We are in a situation in which there are no longer many possible solutions available or the possible solutions lead in a direction that will again be fraught with considerable distortions. The Chinese curse is coming true, we are living in exciting times.

Steffen Egly has been working in IT consulting for over 20 years, predominantly with a technical focus on insurance and banking topics. His fields of activity are insurance portfolio management, accounting, provisioning, loans and impairment.

0 Comments