What are the main ESG challenges for the financial industry and how can they be solved?

The regulation of environmental, social and governance (ESG) regulation of environmental, social and is a new challenge for the financial industry. The regulatory requirements are wide-ranging and comprehensive: from the Non-Financial Reporting Directive (NFRD), the new Accounting Directive, with specifics on the management report, to EU taxonomy and the expansion of disclosure. In order to comply with steering and reporting obligations, the collection of ESG-specific data represents the greatest challenge. These data include, in particular, energy efficiency, NACE codes, CO2 emissions and taxonomy compliance. This requires a clear blueprint in the sense of a functional model that includes how this information is to be located in the system architecture, how it is further processed, calculatedand forwarded to the supervisory authority within the scope of the report.

ADWEKO is one of the leading international business and management consulting firms and an expert in bank management solutions. We tackle the challenges of dealing with sustainability and ESG issues for financial companies along the entire value chain for you: from data integration and modeling to business and IT processes to expert consulting, solution implementation and reporting.

Contact our experts from the Finance, Risk and Regulation competence areas, who will also be happy to involve our specialists from Data Management, Software Solutions and Managed Services.

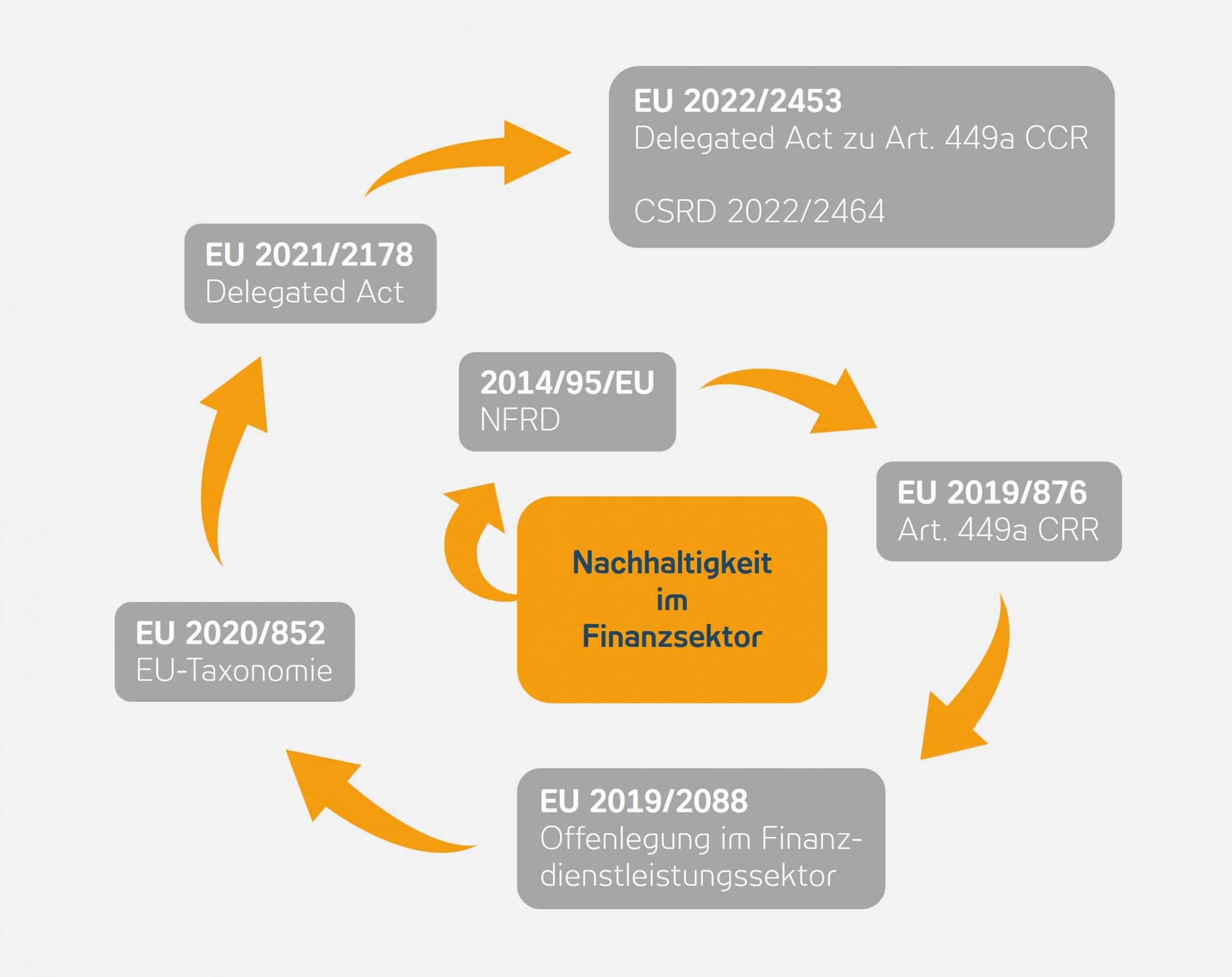

The regulatory path of ESG into finance

Nothing is more constant than change, and so from time to time the financial world faces ever new challenges that at first glance seem far removed from “business”. If the introduction of reporting for credit data statistics and, not least, FinStabDev confronted us with required information, the procurement of which had to be carried out via external providers or our own surveys, incl. the data collection. marketing activities went beyond what was previously known, since the adoption of the Paris Climate Agreement at the end of 2015, the financial industry is simply facing new, outsized challenges. Not least because the plethora of regulatory requirements in this subject area has not been finalized to date, but the first reporting cycles are being run through. The stone of impetus for today’s and future regulatory requirements was laid via the Non Financial Reporting Directive (NFRD) (2014/95/EU) The amendment to the Accounting Directive (2013/34/EU) by introducing the non-financial statement in the management report, which at the time consisted of fairly clear disclosures and therefore appeared acceptable.

Fig.: Chronology of sustainability

The regulatory requirements that follow over time, from the EU taxonomy (2020/852) to the expansion of disclosure under Art. 449a CRR (2019/876) to the Delegated Regulation (2021/2178 ) and the Implementing Regulation (2022/2453) with the specification of the information to be disclosed with regard to environmentally sustainable economic activities, allow for an expansion to the complete range of the financial sector. The focus is no longer only on “ordinary” credit institutions; rather, the interpretation now ranges from non-financial companies, securities managers, investment firms, to insurance and reinsurance companies. The Corporate Sustainability Reporting Directive (CSRD) (2022/2464) also marks the continuation of the extension of the reporting obligation to companies that were not previously subject to the NFRD but will nevertheless have to report sustainability information in the future.

New collection of ESG – specific data

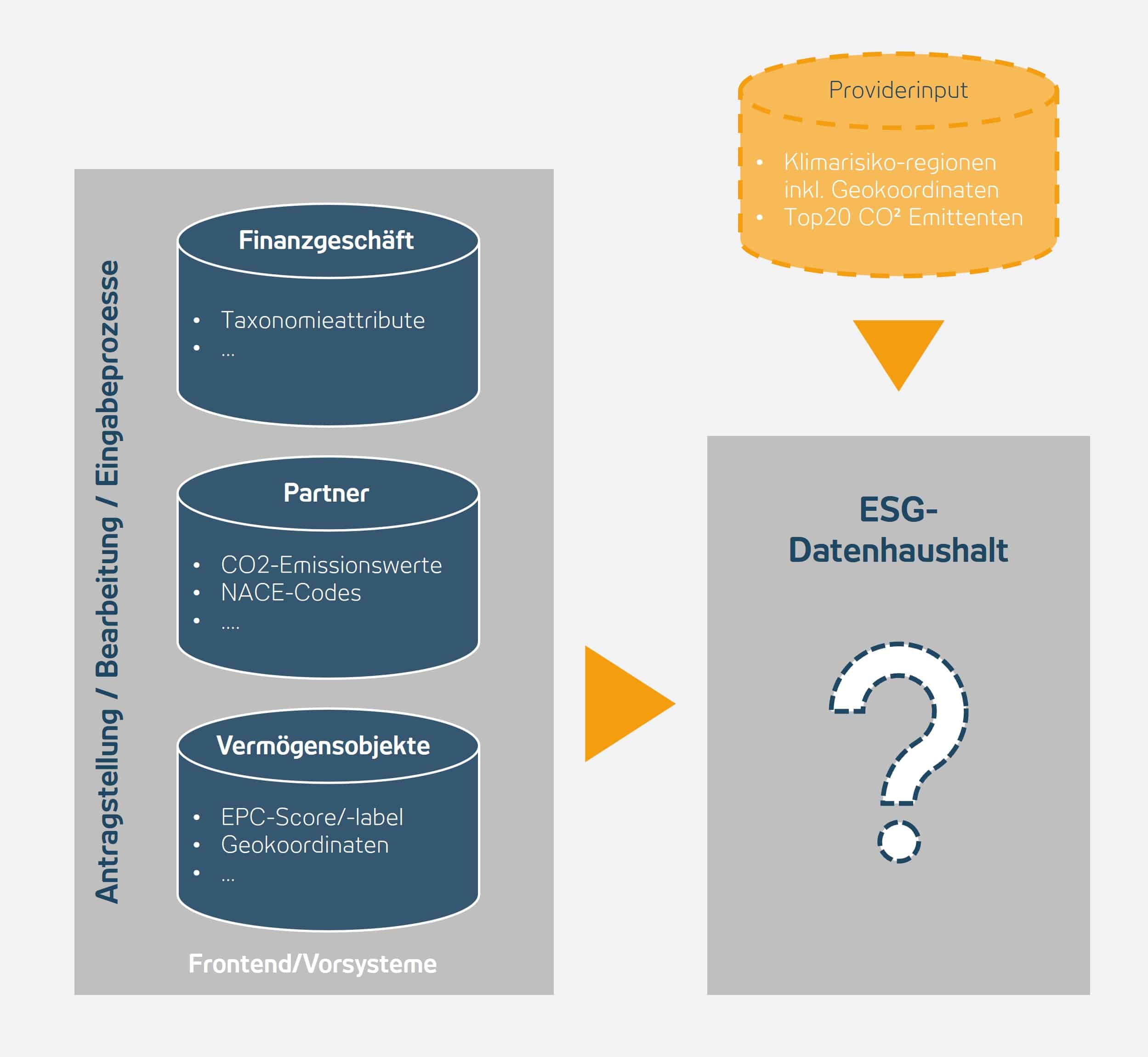

Apart from the spectrum of the target group mentioned in general, a closer look reveals the respective requirements with the not inconsiderable challenges for the reporting party: how or where does the reporting party obtain the required information, how is it located in the system architecture, further processed within the scope of the report and forwarded to the supervisory authority.

Fig.: Structure of virtual ESG data budget

It doesn’t take a deep, analytical look to see that gathering the information is the biggest challenge in the ESG context. For the disclosures in the ESG environment, the following information is required first of all for this purpose and must also be newly obtained in some cases for this purpose. Example of some of the data required listed for illustration:

- EPC score (Energy Performance Certificate)/ EPC label

For loans secured by real estate, information regarding energy efficiency must be reported using EPC scores and labels. The object that is provided as collateral for the loan is relevant here.

-> This attribute is to be seen as a property of the asset object and is also to be located there from a data modeling point of view.

- NACE codes up to level 4

Although NACE codes on counterparties’ industries are often available in banks, there is a need to identify some industries down to level 4 as part of the disclosure. This depth was not necessary in previous reports.

-> This attribute is to be seen as a property of the partner and also to be located there in terms of data modeling.

- Information on CO2 emission values for counterparties up to Scope 3

CO2 emissions to the individual counterparties of the bank are very likely not even available in the system yet. What makes the requirements even more difficult, however, is the need to determine them up to Scope 3, i.e. even along the value chain (suppliers/customers) of the counterparties. However, this information is not relevant until June 30, 2024.

-> This attribute is to be seen as a property of the partner and is also to be located there from a data modeling point of view.

- Taxonomy capability and taxonomy compliance

The EU taxonomy plays a major role within ESG disclosures. It defines whether assets can potentially be classified as sustainable (taxonomy-compliant) and, for 6 defined environmental objectives, also defines technical assessment criteria that, if met, will actually classify an asset as sustainable (taxonomy-compliant). These two classifications play a role in all disclosure forms, but they are particularly relevant for the Green Asset Ratio (GAR), which banks are required to determine as of the reporting date of Dec. 31, 2023.

-> This attribute is part of a multi-level derivation/calculation and ultimately part of the financial transaction. In terms of data modeling, it should be located within the virtual data budget at the financial business.

- Engagement with the top20 most carbon-intensive parties in the world

Banks must disclose their engagement with the top 20 most carbon-intensive parties in the world. A list of these can be found, for example, in the reports of the Carbon Disclosure Project. In order to identify these correctly, it is necessary to map the group structure of the parties correctly so that, for example, business with subsidiaries of one of the parties is also recognized, even if no data on the group is available.

-> This attribute is to be seen as a property of the partner and also to be located there in terms of data modeling. This requires mapping against an external data source.

- Climate risk values for real estate loans affected by chronic and acute climate risks.

For each identified geographic area (e.g., using NUTS codes), information regarding chronic and acute climate risks must be disclosed. In many cases, this information is not available in the banks and presumably has to be obtained from external sources (e.g., (re)insurers). Mapping between properties and regions affected by climate risks (geospatial data) is necessary to determine the risks for individual properties. The information on this was to be submitted on a best-effort basis as early as December 31, 2022.

-> This attribute is to be seen as a property of the asset object and is also to be located there in terms of data modeling. This requires mapping against an external data source.

Modeling of a data map with ESG focus

In the context of complex procurement, the question also arises as to where these ESG-specific data to be located in order to integrate them into the detector’s architectural landscape in a structured manner and with maximum efficiency. Locating the information in the place where it is collected seems natural and should therefore be strived for. In addition, however, it is often necessary to connect external sources to the bank’s systems. But that’s not all. Often, more complex derivation logic must be implemented to obtain the information to be reported. After processing, the data must be prepared for specific customers. The optimal and appropriate integration of ESG data into the existing bank management architecture results in a clearly defined “virtual ESG data budget”, which is represented by means of a data map . It provides an overview of the data flow, processing and preparation. At the same time, this creates a basis for the extensions and innovations to be expected in the future.

In the course of this series on the subject of ESG, a common thread is to be shown in which we take a closer look at the current challenges and closer look and give an outlook on the innovations to be expected in the future.

The next part of the series will cover the topic of “Disclosure in thecontext of ESG regulation” and the associated challenges in the data landscape.