Foreword

ADWEKO is a leading consulting firm for analytical IT solutions for banks and insurance companies with offices in Frankfurt, Stuttgart, Hanover and Hamburg. Since 2008, we have been supporting our customers with consulting services, managed services and software development. As experts in the financial services industry, one of our consulting focuses is on the core process of all in the credit industry: the digital transformation of credit management!

In the age of advancing digitalization, the banking and insurance markets are literally forced to rethink their business models and adapt processes. Virtual banking solutions and FinTechs are intensifying competition in this market segment and challenging the industry to increase efficiency and optimize resources – all while complying with current regulatory standards. The demand for a suitable technology that can serve all these challenges is growing and continues to fuel interest in Robotic Process Automation (RPA). In the financial industry, RPA is a useful tool not only to meet the urgent needs of credit institutions or to maximize efficiency, but in addition to reduce costs and meet claims of regulatory requirements. To seize this opportunity, taking a strategic approach to process optimization is essential.

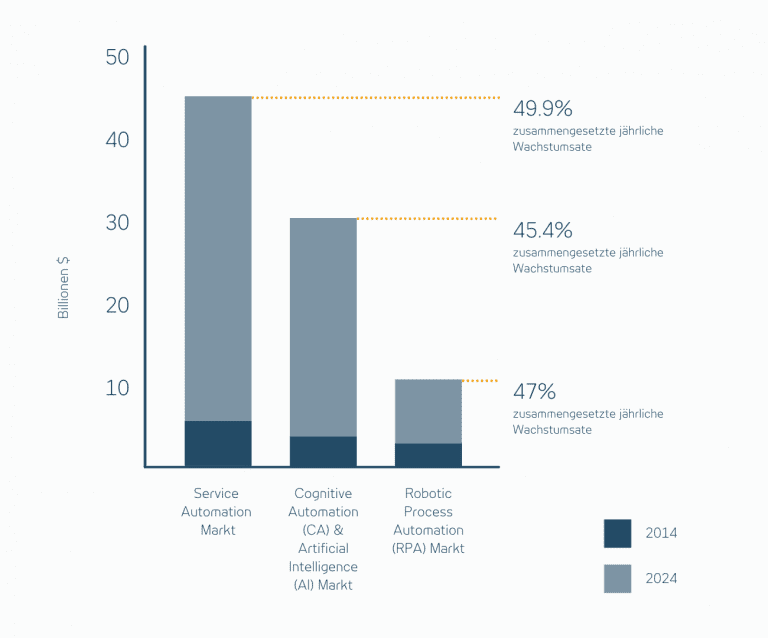

Various studies confirmed the promising future prospects for the service automation landscape. Already in 2018, the service automation market was approximately $4.1 billion, with a projected increase to $46.5 billion by 2024.1

The optimization of credit processes can be achieved in a variety of ways. In addition to the integration of new IT solutions and the digitalization/simplification of processes, automation potential can be leveraged in a short time using Robotic Process Automation (RPA). RPA offers numerous benefits across many different industries. ADWEKO can help you realize your goals as efficiently as possible with customized RPA solutions.

Figure 1: Market segmentation of different service automation technologies and their growth forecasts 2018-2024 2

2. background to Robotic Process Automation

Robotic Process Automation (RPA) is a solution approach which provides the ability to create, manage and control software robots. The so-called bots mimic human actions on the desktop and assist in performing tasks that are fundamentally manual, repetitive and time-consuming. For example, the bots identify and extract data from platforms and execute defined actions that have already defined a specific output in advance.3

Overall, a distinction can be made between different RPA tools:

- Desktop Automation Tools

- Enterprise RPA Tools

- Professional IT Software Tools

- Cloud RPA

Each of these tool types has different properties and comes with limitations that determine how it works.4

Focus: RPA for back office automation

In the financial sector, esp. in the back office area, RPA technology and its positive effects are increasingly coming into focus. Massive cost and efficiency pressures in particular are driving this development. If earnings can no longer be increased adequately, the only remaining option is often to cut costs as a means of stabilizing or growing earnings. The following aspects can be highlighted to optimize underperforming back-office areas:

- Centralization of the back office areas and the associated budgets

- Cross-divisional standardization of processes

- Process optimization to reduce errors and minimize waste

- Relocation of back-office operations from expensive to less expensive locations (“offshoring“)

- Technological advances, for example self-service portals

- RPA – Automation of relevant processes

The possibility of process automation using RPA brings out a sixth lever. While the first five guiding ideas have been widely applied to date, RPA in particular has only gained significant popularity in recent years.5

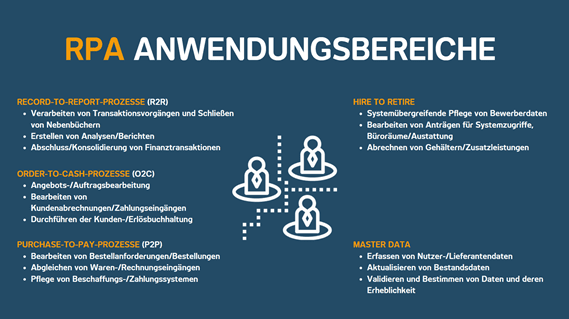

General application scenarios with RPA

Where is the implementation of an RPA solution worthwhile?

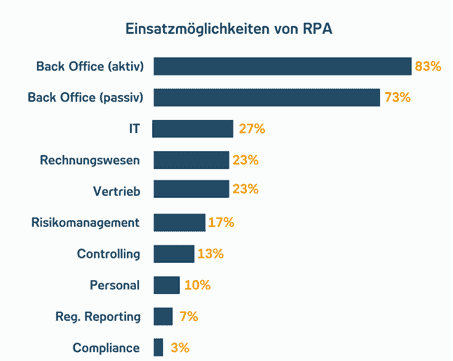

In the context of an RPA implementation, certain minimum requirements must form the basis so that business processes can be automated at all. The processes must be standardized, structured and rule-based. This means that, in addition to a low level of diversification, they are appropriately defined and documented. Ideally, these are recurring and repetitive processes that have low complexity and few exceptions. In this context, processes in the banking sector that do not fully meet these requirements initially can also be reasonable candidates for an RPA solution. An exact analysis of the data, circumstances and the general situation is necessary to show these potentials. The following graphic illustrates the application areas in which RPA solutions are already being used:

Figure 2: Possible uses of RPA (area-dependent) 6

From ADWEKO’s perspective, the application areas have evolved since the 2019 survey; for example, we have already successfully implemented robots in the area of accounting and overall bank management to meet the need for increased efficiency and cost reduction.

4.0 Principles of action

After a basic understanding of RPA has been established in the previous sections, the following chapter deals with the principles of action.

Studies show that applying the following action principles in risk areas of an RPA project is essential to achieve business value for shareholders, customers and employees. Here, the usefulness of the methods depends mainly on four factors:

- the defined goals,

- the unique context of the organization,

- a coordinated allocation of resources,

- and a time coordination.

This results in the following four principles of action to mitigate the risks, which correlate closely with the use of a strategic approach to implement RPA as efficiently as possible.

4.1.1 RPA as part of a larger corporate strategy

Digital transformation is one of the trends that will greatly influence the future society. In the business environment, digital restructuring can enable end-to-end processing, allowing customers to search for, order/complete, pay for and receive products and services online. It requires executive buy-in and a digital visionary who understands and positively influences the customer journey.7

4.1.2 C-suite motivation to pursue a culture of automation

Institutions where the C-suite8 culturally embraces and drives automation derive exponential value from RPA – unlike companies where IT or other departments try to control and silo the process from the bottom up. The C-Suite has the influence and reach to mobilize resources and appoint an appropriate project team to drive the project with sufficient resources.9

4.1.3 Responsibility for the automation process

When implementing an RPA project, it is common for the business process automation to be configured lead by the business operations/department, such as the enterprise and desktop RPA tools. In the case of more complex automation, IT should be called in to provide support and implementations should be communicated with IT in order to avoid cross-effects.10 ADWEKO generally recommends setting up a center of excellence in which the stakeholders of the RPA project share responsibility.

Success factors for RPA

In addition to observing the principles of action, there are other success factors to consider for a sustainable successful RPA implementation.12

4.2 When is RPA suitable?

When effectively automating processes using RPA technology, it is important to consider certain criteria:

- digitally readable data

- Structured and uniformly prepared data (maturity level)

- Rule-based existing process flow with as few exceptions as possible

RPA is suitable for task processing and process automation that have a medium to high volume of transactions and a low to medium level of process complexity. The robot interacts with other software applications in the same way as human employees, for example by authenticating themselves with user names and passwords. In principle, it is possible to apply robots to any software that humans use for task processing.13

In principle, RPA can be considered a “lightweight IT” that does not need to be managed by an IT team and represents a cost-effective solution compared to other BPM variants. RPA technology is easy to configure and does not require in-depth programming knowledge. In addition, the RPA software is non-invasive, meaning that the RPA robot does not deeply access the existing systems.

5. recognize opportunities & exploit potential

After the processes to be automated have been sufficiently examined with regard to their underlying prerequisites (process evaluation), the following added values can be identified and realized after an RPA implementation:

5.1 Shareholder value

5.1.1 Savings potential through RPA investment in the first year

According to project studies, the return on investment after the first year is between 30 and 200 percent and reflects the added value for the shareholder. Proven rapid ROI achievement within the first day after go-live delivers secure competitive advantage in the business environment.14

5.1.2 Increasing efficiency and productivity for optimum process speed

Get started quickly with straightforward and simple licensing, low-code development, and deployment options that increase efficiency and productivity. Process cycles can be carried out more efficiently with an optimised work-output to personnel-input ratio. This relief reduces error-proneness and enables an increase in employee motivation. The result means added value for the company, employees and the customer.15

5.1.3 Meeting compliance requirements

The configuration of RPA provides for predefined processing according to fixed rules. Implicitly, a consistent execution procedure is ensured, whereby variations in work steps are reduced to a minimum. Audit trail generation and automated log maintenance ensures compliance.

5.1.4 Scalability optimization

RPA technology enables companies to respond to volatile demand at short notice. As a result, a more efficient allocation of resources as well as a strategic advantage can be realized.

5.1.5 Adaptability

RPA robots can be adapted at any time to accommodate new or changing process rules as well as data types over time and do not require complex training compared to employees.16

5.1.6 Flexible workforce

RPA provides 24/7 work performance with no absences. For example, in a shared services organization, RPA can support accounting during the day and payroll overnight. A mix of RPA and human workers can be a powerful combination – if used correctly and allocated in a targeted manner.

5.1.7 Competitive advantage

RPA delivers a competitive advantage by helping to pursue agility in the business, respond quickly to market opportunities, and improve the customer experience.17

5.1.8 Potential cost savings

The use of RPA supports the detachment of repetitive and time-consuming business processes. Resources can be used for other value-adding work processes.

5.1.9 Quality increase

The use of RPA robots reduces the error rate in predefined process handling, which in turn has a positive effect on quality.

5.1.10 Time savings due to high process speed

The transactional process speed is significantly increased. Previously tied-up capacity and resources can be allocated elsewhere through optimized process handling time, enabling a reduction in general process costs.18

5.2 Optimized service experience / customer value

The optimized error rate, higher speed of service delivery, consistency and availability provided by RPA enables new services to be brought online, helping to continuously improve the customer journey.19

5.3. Employee value

“RPA takes the robot out of the human,” taking over the monotonous tasks and allowing the employee to focus on the activities that contribute to solving the problem and form a high added value for the companies. This not only promotes data quality, but also the employee’s creativity, empathy and emotional intelligence, as well as his or her personal development within the company.20

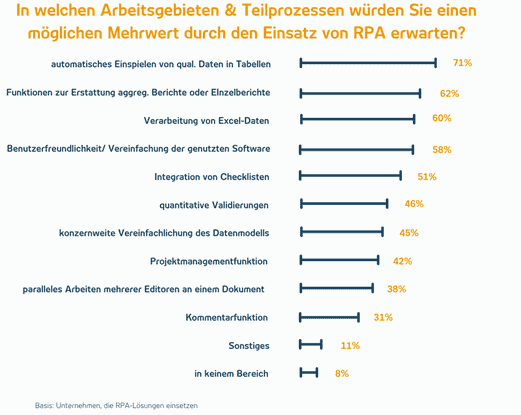

Figure 3:Potential added value through RPA solutions 21

6 Exemplary Use Cases in the Banking Sector

6.1 Account limit change

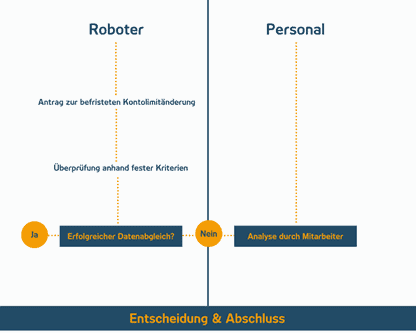

Figure 4: Process example – account limit change

Online banking has become a matter of course for a large number of customers. In addition to account inquiries and the manual set-up of standing orders, account limit changes can now be carried out conveniently from the comfort of your sofa via online banking. Based on this online service, the customer is able to temporarily or permanently adjust his limit for online transfers to his individual needs.

Without the use of RPA, any change would have to be recorded manually within regular banking hours and analyzed manually by the respective customer service representative.

With the help of RPA, the application is completed by the customer in online banking and then checked by the RPA solution using a clear set of rules and defined criteria (e.g. checking available credit) and processed on a case-by-case basis. The automation rate for this use case is nearly 100 percent.22

6.2 Lending to retail customers

Lending to private individuals is a typical, recurring and standardised process in a bank. The responsible clerk checks the customer’s creditworthiness with a great deal of manual effort. Writing e-mails, SCHUFA queries, creating scores/ratings and the necessary entries in the bank’s various credit processing systems are typical manual procedures in a credit approval process. This process, which is currently still predominant in many banks, is carried out on average 10 to 20 times a day and ties up the responsible clerk almost his entire working day with tasks that correspond to the application scenarios of RPA (approx. 80% of his total working time).

With the help of an RPA solution, many of these processes could be simplified and automated. As before, the clerk receives all important customer and credit information. However, RPA eliminates a lot of manual work. The clerk simply launches the RPA bot and it automatically performs the previously dull and repetitive action sequences.

RPA accesses existing systems with ordinary employee access and permissions and interacts as a human agent would actually do their job. The RPA bot collects the necessary information in the credit processing systems and transfers the existing data to the credit checking system. There, all necessary steps are automatically initiated and PDF documents as well as scores/ratings are created. After the verification is done, the RPA bot copies the necessary documents and provides them to the loan processing system, performs an identity check, and then provides the information to the loan officer.23

By means of an RPA solution, it is thus possible to automate this (simplified here) credit check process almost completely, to relieve the clerk and thus free up time for other (more valuable) activities.

7. ADWEKO RPA Service Offering

RPA offers numerous benefits across many different industries and organizations. ADWEKO helps you to unfold your potentials through tailor-made RPA solutions.

The following process automations have already been successfully implemented by our RPA experts at ADWEKO:

- Automation of mapping from front data to end data and generation of F2E recons for retail and wholesale loans as an RPA solution.

- TSP for newly introduced data quality enhancing processes in the context of BCBS 239.

- Process analysis and evaluation to identify suitable processes for RPA

Whether it is an initial analysis of future automation potentials through a process analysis and evaluation, you have specific questions about RPA or you are considering concrete implementations with RPA:

We are at your disposal as a competent contact partner.

Our RPA experts will be happy to advise you on the path of your digitization strategy using innovative, customer-specific solution approaches for the automation of business processes.

Dominica Krüger

Central contact person for RPA

List of sources

1 This would imply a compound annual growth rate (CAGR) for TSP of 47%.

2 Statista. 2017. robotic/intelligence process automation (RPA/IPS) and artificial intelligence (AI) automation spending worldwide from 2016 to 2021, by segment (in billion U.S. dollars).

3 Smeets M., Erhard R., Kaußler T. (2019) Robotic Process Automation – Background and Introduction. In: Robotic Process Automation (RPA) in Finance. Springer Gabler, Wiesbaden. https://doi.org/10.1007/978-3-658-26564-9_2

4 E.g. Robots that work with as well as without human interactions. Willcocks, L. & Lacity, M. 2016. Service automation robots and the future of work. Stratford: SB Publishing.

5 Smeets M., Erhard R., Kaußler T. (2019) Robotic Process Automation – Background and Introduction. In: Robotic Process Automation (RPA) in Finance. Springer Gabler, Wiesbaden. https://doi.org/10.1007/978-3-658-26564-9_2

6 zeb_RPA-Study.pdf, ROBOTIC PROCESS AUTOMATION IN THE FINANCIAL SERVICES INDUSTRY, RPA Study 2019: Potentials, Challenges and Success Factors.

7 (Lacity & Willcocks, 2018)

8 C-Suite refers to the top level management positions in a company, usually starting with the letter “C”, for “Chief”, such as Chief Executive Officer (CEO), Chief Financial Officer (CFO), etc.

9 (Lacity & Willcocks, 2017)

10 (Lacity & Willcocks, 2017)

11 Willcocks, L., Hindle, J. & Lacity, M. 2019. Becoming strategic with robotic process automation. SB Publishing: Stratford.

12 Own presentation based on: (Smeets et al., 2019, p.122)

13 (Koch & Fedtke, 2020) & Asatiani, A. & Penttinen, E. 2016. Turning robotic process automation into commercial success – Case OpusCapita. Journal of Information Technology Teaching Cases. (6):67-74. Willcocks, L. & Lacity, M. 2016. Service automation robots and the future of work. Stratford: SB Publishing.

14 Source ZEB Study (Willcocks, Hindle & Lacity, 2019).

15 Koch, Christina & Fedtke, Stephen. (2020). Robotic Process Automation: An Executive’s Guide to Successfully Implementing and Operating Software Robots in the Enterprise. 10.1007/978-3-662-61178-4.

16 The robot number can be adjusted as needed. à ? (Lacity & Willcocks, 2017)

17(Lacity & Willcocks, 2017)

18 (Smeets and Erhard et al., 2019); Smeets, M., Erhard, R., & Kaußler, T. (2019). Robotic Process Automation (RPA) in Finance: Technology Implementation Success Factors for Decision Makers and Users. Springer-Verlag.

19 (Lacity & Willcocks, 2017).

20 Lacity, M. & Willcocks, L. 2017. Robotic process automation and risk mitigation. Stratford: SB Publishing. Lacity, M. & Willcocks, L. 2018. Robotic process and cognitive automation: the next phase. Stratford: SB Publishing. (LSE Note “6. The art of the triple-win”, Link: 2.1 Notes: The attributes of a strategic approach to service automation [± 90 minutes]: The art of the triple-win (getsmarter.com) Shareholder value, Customer value, Employee value

21 Source of statistics: Robotic Process Automation (RPA) in the DACH region with a view to Finance & Accounting(www.pwc.deAnalyse)

22 A major benefit of RPA can be to expand the criteria and be able to perform a more detailed & accurate review using additional data. > Source Case Study BBBAnk Source

0 Comments