Classic AFI versus Smart AFI versus FPSL

Many financial services institutions already know or use SAP’s Classic AFI or smart AFI finance and accounting solutions. AFI is an acronym for Accounting for Financial Instruments, which was developed specifically to account for the large and complex financial instrument portfolios of banks and insurance companies. SAP recently launched an updated version, a revolution, of its subledger solution for financial products: SAP S/4HANA for Financial Products Subledger , SAP FPSL for short.

SAP FPSL is designed not only for specific institutions, but for the entire financial services industry and other companies. On the one hand, FPSL helps banks, insurance companies or reinsurers to simplify accounting for the large amount of complex financial products on their books. On the other hand, it also supports e.g. fintechs or corporations to increase the efficiency of their subledger accounting. In addition, unlike classic AFI and intelligent AFI, SAP FSPL introduces an entire component designed specifically for insurance contract billing.

From a technical perspective, SAP FPSL is used as an add-on to SAP S/4HANA . However, this does not necessarily mean that S/4HANA is a prerequisite for FPSL. However, with the seamless integration of the SAP FPSL subledger solution and the S/4HANA general ledger, customers can leverage synergies within their accounting and finance departments by combining both SAP products. SAP FPSL leverages the capabilities of SAP HANA and is equipped with a simplified core and an optimized data model to efficiently process large amounts of data. The fact that FPSL can be used on the basis of SAP Fiori guarantees a simple and modern user interface.

FPSL and compliance with (inter)national accounting standards.

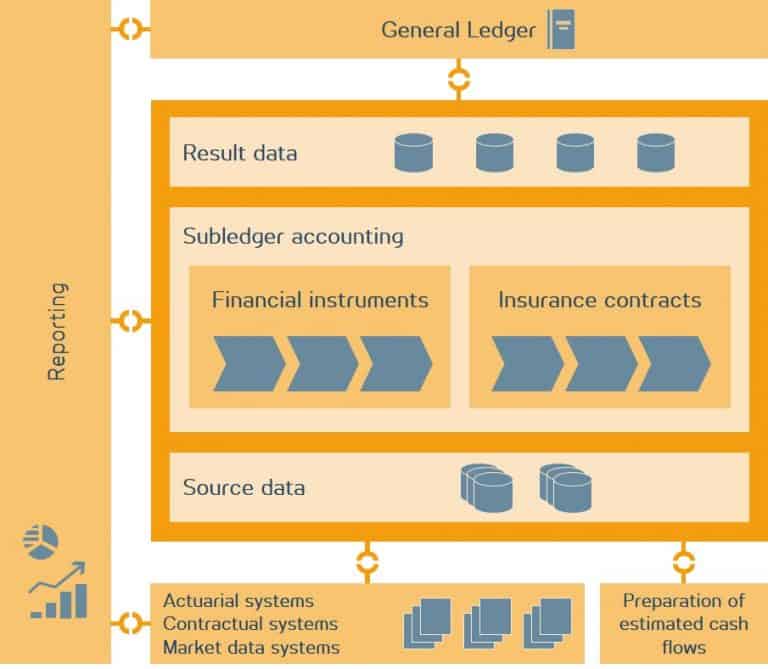

How does SAP FPSL and its architecture help financial services institutions comply with international accounting standards? SAP FPSL is equipped with accounting components that specifically enable business users to value financial instruments and insurance contracts not only from a local GAAP perspective, but also from an international GAAP perspective. For this purpose, the SAP standard FPSL provides multi-GAAP and multi-currency functionalities. The underlying central and delta GAAP approach is based on the logic that cross-GAAP entries are created only once, while GAAP-specific entries are created once per accounting principle.

SAP FPSL, and thus subledger accounting, is seamlessly integrated into an institution’s overall accounting process. Each relevant source system provides the data and business values needed in FPSL to create subledger documents at the contract or portfolio level. To link the subledger and the general ledger, SAP FPSL aggregates the subledger documents into general ledger documents and sends them to the general ledger (via standard interfaces). In doing so, it provides all data and accounting information required for closing periods and reporting purposes.

The ADWEKO FPSL Experience

SAP S/4HANA for financial products subledger (SAP FPSL) is the new SAP solution for efficient subledger accounting of financial products. ADWEKO supports you in the implementation of FPSL for standardized and compliantly secure accounting processes.

- Professional consulting from implementation and commissioning to project management and testing

- Lean architecture through the use of one database for multiple analyzers and computer systems

- Connection and integration of existing pre-systems and implementation in existing databases as well as in existing databases

- Smooth and time-efficient deployment with the help of best practice solutions

- Migration from Classic AFI to SAP FPSL

Also interesting

Landing Page S/4 HANA Finance: https://www.adweko.com/de/loesungen/consulting/finance/sap-s4hana-finance/

Manuel Rauscher is Principal Consultant at ADWEKO International. Since he joined ADWEKO in 2015, he has advised national and international financial services institutes within the sectors automotive, retail and payments. In this blog, he focuses on SAP S/4HANA for Financial Products Subledger (FPSL).

0 Comments